Putting a robust invoicing and expense-tracking system in place from day one can prevent you from plunging into complete chaos at the end of the financial year. Once you register your business, you’ll be legally required to file tax returns and pay taxes.

So, are you really interested in freelancing? While every country has its own laws and types of business structures available for freelancers, the key factors to consider remain the same regardless of where you live or work. Setting up as a freelancer is a little bit like setting up your own business. The most distinct difference between freelancers and gig workers is that the former tend to rely on the internet to deliver their work.

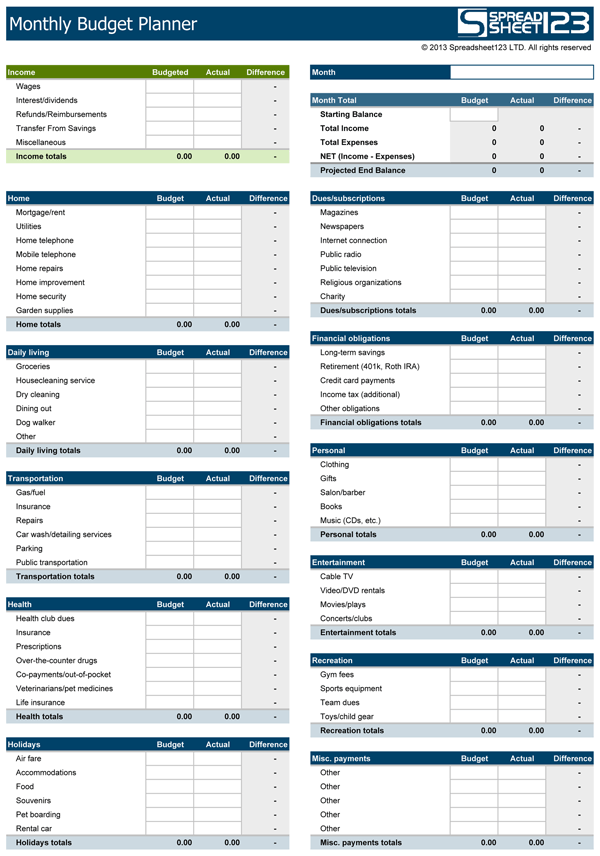

#Creating a personal budget lance drivers

There is, however, another group of self-employed professionals that often get classed as ‘gig workers’ or ‘contractors.’ Self-employed handymen, cleaners, construction workers and drivers would fall into this category. There are many different types of freelancers, but they tend to be knowledge workers who possess a high-level of skills and knowledge in a certain area, such as designers, writers, programmers, translators, project managers and so on.

At the same time, self-employed professionals can set their own working hours and make working arrangements that fit their lifestyle – either working remotely or from their clients’ offices. Since they work for themselves, freelancers must also cover their own holiday costs and sick pay. Instead of being employed by a company, freelancers tend to work as self-employed, delivering their services on a contract or project basis.Ĭompanies of all types and sizes can hire freelancers to complete a project or a task, but freelancers are responsible for paying their own taxes, health insurance, pension and other personal contributions. First thing's first: what is freelancing?įreelancing is a type of self-employment.

0 kommentar(er)

0 kommentar(er)